What are control accounts?

A control account also referred to as a controlling account, is an account within the general ledger that summarises all the transactions of a specific type. A control account has a corresponding subsidiary ledger that contains all the detailed transactions relating to that account, which may be in the hundreds or thousands. The purpose of the control account is to avoid copious amounts of information within the general ledger.

For example, an accounts receivable control account will summarise the accounts receivable subsidiary ledger balance. The subsidiary ledger contains the detailed transactions of all sales made to vendors.

The subsidiary ledger is a separate ledger from the general ledger and supports the controlling account. It will contain extra details, not within the control account, such as payment details, where, when, and who made the payment. The value in the subsidiary ledger is periodically posted to the control account, thereby freeing the control account of too much detail and ‘clutter’.

The control account will display the accumulated balance of the corresponding subsidiary ledger, and the end balance must always reconcile with the end balance of the control account. If they do not match, it indicates a mistake somewhere along the way.

Control accounts are commonly used for accounts payable and account receivable, which typically experience a high volume of transactions. Control accounts may also be used with other accounts such as inventory, cash, fixed assets, or any other accounts that experiences a larger volume of transactions.

What are the advantages of using a control account?

- Identify Errors

The control account must always balance with the subsidiary ledger. If the control account does not match the subsidiary ledger, it will indicate the account contains an error. The accounts can be reconciled to locate and correct the error. - Reduce clutter

Without a control account, the general ledger may contain an enormous amount of transactions. Rather than a detailed list of transactions, control accounts and subsidiary ledgers record the accumulated balance in the general ledger making it less cluttered and easier to focus on the higher-level data. - Fraud detection

A control account allows for a separation of duties between the person managing the subsidiary ledger and the control account, thereby helping to check and prevent fraud.

Control account example

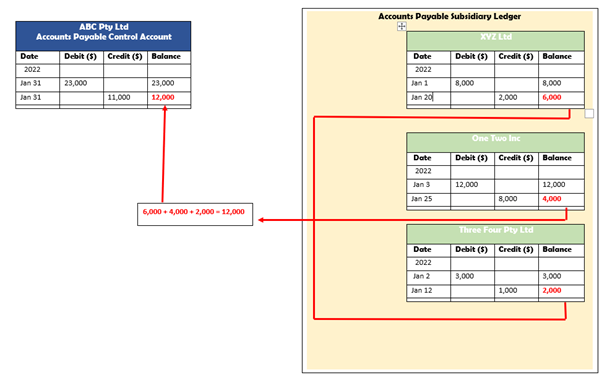

This simplified example will use the accounts payable subsidiary ledger and accounts payable control account.

• Jan 1st ABC Pty Ltd makes a purchase of $8,000 from XYZ Ltd

• Jan 2nd ABC Pty Ltd makes a purchase of $3,000 from Three Four Pty Ltd

• Jan 3rd ABC Pty Ltd makes a purchase of $12,000 of raw materials from OneTwo Inc

• Jan 12th ABC Pty Ltd pays $1,000 to Three Four Pty Ltd

• Jan 20th ABC Pty Ltd pays $2,000 to XYX Ltd

• Jan 25th ABC Pty Ltd pays $8,000 to One Two Inc

• Jan 31st The Accounts payable subsidiary ledger balances are aggregated and posted to the Accounts payable control account.

As you can see from the example, the accounts payable subsidiary ledger balances match the accounts payable control account balance.

How Accario can help your business to focus on what you do best?

At Accario, no client is too big or too small to benefit from the time savings, cost savings and exceptional service we provide. We service clients from franchise groups with over 200 individual stores, all the way down to small businesses with 1 to 2 staff members. We provide a wide range of services from accounting, bookkeeping, and payroll management to virtual assistance to manage your business administration.

Why wait? Let’s get connected now!

Are you ready

to get your time

back?

Yes! Accario will help you

focus on your business

More smarts, more efficiencies,

with more benefits.